The true significance of municipal governance is lesser known and yet the most important. It literally affects every aspect of our daily lives; from access to clean drinking water, frame by-laws, garbage collection, to new housing and transportation, etc. If you look out of your window and see construction cranes dotting the horizon, apartments and large offices changing the city’s landscape dramatically, roads being constructed and garbage vans picking up trash from homes; that’s your local municipality in action.

Let us understand what a Municipal Corporation is. In layman terms, it is a local governing body in cities, towns, villages, counties, boroughs, and townships that helps administer urban areas with large populations. Municipal Corporations happen to be vital to India, considering its growing population and increasing urbanization. This type of local governing body is required to provide services such as Healthcare, Housing, Education, and Transport by collecting Property Taxes and administering grants from the State government.

In different states, the Municipal Corporation goes by different names, according to regional languages. In Karnataka, it is referred to as Mahanagara Palike; and in Bengaluru it is known as Bruhat Bengaluru Mahanagara Palike (BBMP) which is the administrative body responsible for civic amenities and infrastructural management of Greater Bengaluru.

Understanding Municipal Corporators:

Municipal Corporators form the most fundamental unit of a local Municipal Corporation. They are the base level officials in the Municipal hierarchy and therefore bridge the gap between the citizens and the council. In order to decentralise the power of urban governance, forge a path towards active citizen participation and to establish transparency and accountability, the concept of Municipal Corporation and wards came into existence.

A ward is the smallest unit of urban governance with a population of approximately 40,000 – 50,000 citizens who elect their respective municipal corporator once in every 5 years. Each ward has one seat in the Wards Committee and some seats are reserved for scheduled castes, scheduled tribes, backward classes and women. The Municipal Corporators elect a Mayor/ Chairperson who presides over committee meetings, but the executive power rests solely with the Municipal Commissioner, a bureaucrat appointed by the State Government. The Mayor and the Corporators have no power over the Commissioner.

In addition to the Corporators elected from the wards, the State Legislature too exercises its rights to choose Municipal Corporators in order to make provisions for the representation of those having special knowledge or experience in municipal administration.

Powers & Functions:

Major powers and functions of Municipal Corporators/Corporations are statutory functions derived from the provisions of the Act, rules and regulations, which are further subdivided into legislative, executive, administrative and financial functions.

- Legislative Power Of Municipal Corporators: The Municipal Corporators collectively form the legislative wing of the Local Government, which allows them to make important decisions about priorities in public policy, passing of resolutions and enacting of By-Laws. The Corporators can further make provisions for punishment in case of breach of any municipal law. The Corporators always have a prevailing voice in the council meeting although the Chairman presides over it, as no policy resolution can be passed without the approval of the majority of Corporators. However, in case of a tie, the Chairman can cast his vote.

For example: if certain proposals are placed before the council for construction of drains, public urinals or a road, it is the Corporators who decide which proposal is to be considered first. The Corporators in other words, take policy decisions as well as they enjoy the power of transacting their ideas into action.

- Executive Powers Of Municipal Corporators: Some Indian states also vest a good deal of executive power upon the Municipal Corporators wherein they exercise their authority to appoint members of different committees.

For example: Orissa Municipal Act. 1950 states, the municipal committee consists of members not less than three or more than six who are elected, as well as ex-officio members 1/3rd members are nominated and the rest members are elected by the Municipal Council.

- Administrative Powers Of Municipal Corporators: The statutes authorize municipal corporators to supervise and control municipal activities related to public health and sanitation, public works, public and private markets and registration of births and deaths and marriages etc. The corporator also takes adequate care in ensuring cleanliness, maintenance of public facilities etc.

For example: If a Municipal Corporator finds any leakage, damage or pollution within the water supply of his ward, he/she immediately raises notice to the council and initiates discussion on the issue. He/She becomes instrumental in taking disciplinary actions against accountable persons.

- Financial Powers Of Municipal Corporators: The most important work of the Corporators is to deliberate on the budget proposal and finally to approve the annual budget of the municipality. They are further allowed to generate revenue by imposing taxes, fines and charging rents.

The Roles & Responsibilities Of Municipal Corporators:

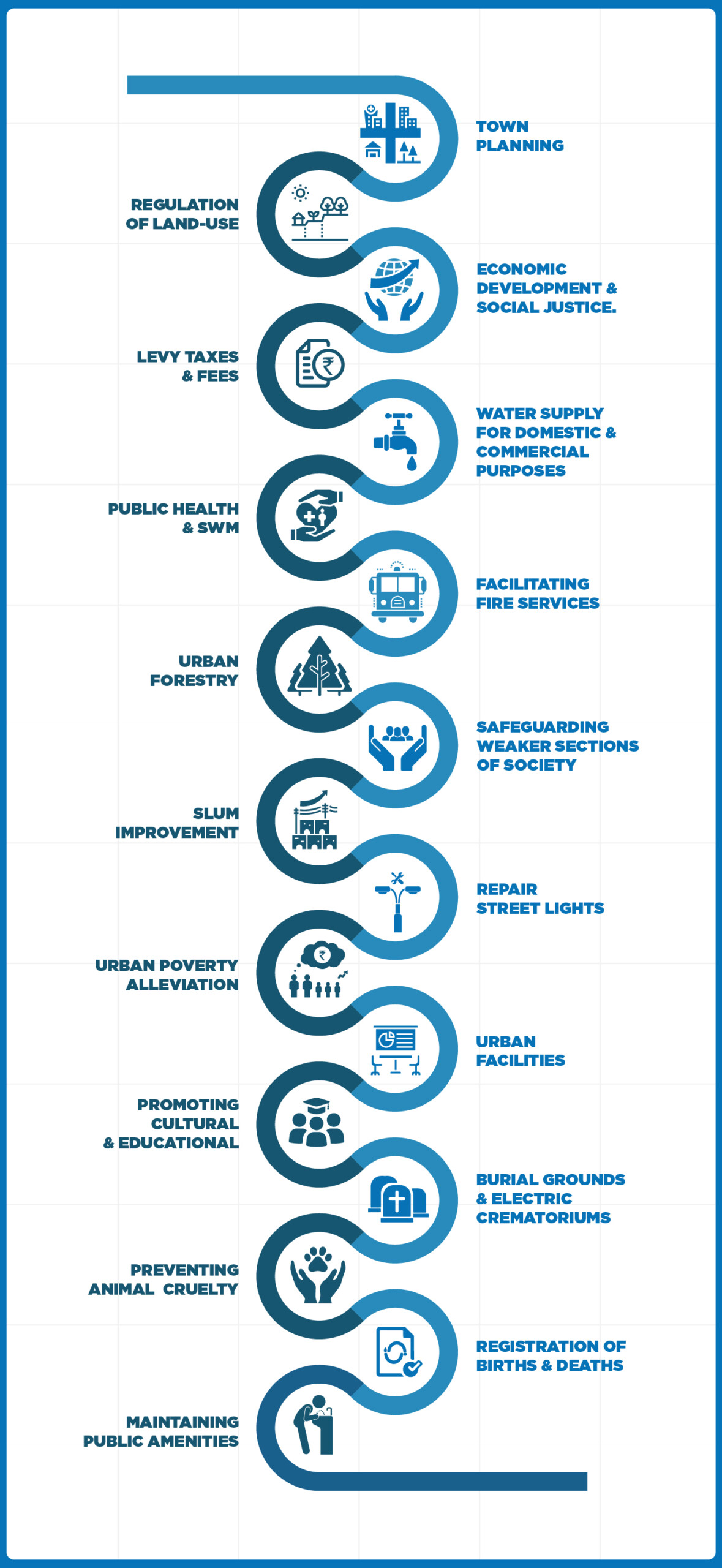

The Municipal Corporation bears the responsibility of every civic issue relating on local level; policies of which are dictated by the 74th Amendment Act, 1992 of Constitution of India. In general, the Corporators are a key cog in the wheel of development and ensure that the city’s people enjoy a certain quality of life; a good quality of life. As per Twelfth Schedule of the Constitution, the corporators are entrusted with following important roles:

- Urban planning including town planning and infrastructure development.

- Regulation of land-use and construction of buildings and other properties.

- The preparation of plans for economic development and social justice.

- Authority to levy, collect and appropriate such taxes, duties, tolls and fees in accordance with procedure.

- Water supply for domestic, industrial and commercial purposes.

- Public health, sanitation conservancy and solid waste management.

- Facilitating fire services and emergency relief activities.

- Urban forestry, protection of the environment and promotion of ecological aspects.

- Safeguarding the interests of weaker sections of society, including the handicapped and mentally disabled

- Slum improvement and upgradation.

- Repair street lights.

- Urban poverty alleviation.

- Provision of urban amenities and facilities such as parks, gardens, playgrounds.

- Promotion of cultural, educational and aesthetic aspects.

- Burials and burial grounds; cremations, cremation grounds and electric crematoriums.

- Cattle pounds; prevention of cruelty to animals.

- Vital statistics including registration of births and deaths.

- Public amenities including street lighting, parking lots, bus stops and public conveniences.

- Regulation of slaughterhouses and tanneries

The Revenue Sources Of Municipal Corporations:

Local Municipalities have multiple sources of revenue generation, such as tax and non-tax revenues, which they generate on their own; a chunk of revenue is allocated by the State Govt.; and some amount is collected through fines and fees. But owing to the fast pacing urbanisation and infrastructure development, independent revenue generation often faces challenges and falls short of their expenditure requirements. Thus, most local bodies depend significantly upon grants from the State and Central governments; and borrowings from financial institutions.

Tax revenue: Property tax, vacant land tax, taxes on advertisements, carriages and carts.

Non-tax revenue: Municipal fees, hire and sales charges, lease amounts.

Other receipts: Sundry receipts, lapsed deposits, fines and forfeitures, rents on tools and plants.

Grant-in-aids: Amount allocated by State Govt. or Central Govt. for various projects and schemes.

Borrowings: Loans undertaken from Life Insurances and State or Central Govt. Banks.

Bruhat Bengaluru Mahanagara Palike (BBMP) In A Nutshell:

The history of municipal governance of Bengaluru dates back to March 27, 1862, when leading citizens of the city took the initiative to form a Municipal Board under the Improvement of Towns Act of 1850. Later, a similar Municipal Board was also formed in the Cantonment area of Bengaluru at the time.

The aftermath of Indian Independence, witnessed a historical change when the two Municipal Boards were merged to form the Corporation of the City of Bangalore in 1949, under the Bangalore City Corporation Act.

In January 2007, the Karnataka Government issued a bill to merge the areas under existing Bangalore Mahanagara Palike with 7 City Municipal Councils (CMCs), one Town Municipal Council (TMC) and 111 villages around the city to form a single administrative body, Bruhat Bangalore Mahanagara Palike. The process was completed by April 2007 and the body was renamed ‘Bruhat Bengaluru Mahanagara Palike’.

BBMP Ward Corporators: BBMP is divided into 8 zones, for the ease of administration each administered by a Zonal Commissioner. The zones are further subdivided into clusters of wards which are managed by respective Ward Corporators and Ward Committees. There are a total of 243 wards in Bengaluru and one Ward Committee per Ward. The Ward Committee consists of 10 members to be nominated by the Corporation (at least 2 SC/ST, 3 women, 2 from registered associations). The Ward Councillor is the Chairperson of the committee, and the secretary is the Assistant Revenue Officer who represent about 40,000 to 50,000 population each in their individual wards.

As per Section 13A of the KMC Act, each Ward Committee shall consist of:

- Councillors of the corporation representing the Wards.

- Not more than five persons who have knowledge and experience in municipal administration, nominated by the Government.

- Not more than two members nominated by the Government from NGOs and community-based organizations (CBOs) working within the area of the Wards Committee.

Improving The Functioning Of Municipal Corporations:

Currently, Municipal Corporations do not have enough leverage to raise independent funds, which leads to states being burdened by assigning a significant portion of their finances for such expenses. Even if these local bodies are allowed to raise funds independently under State Acts, it requires approval by the State Government, which perpetuates their dependence on the State. Especially after the onset of the COVID-19 pandemic, it has become vital for local governments to be self-sufficient and fiscally independent. As per independent research conducted by Vidhi Centre Of Legal Policy, one of the best ways to ensure self-reliance among local bodies is improving Property Tax collection by broadening tax base, revising its calculation process and enhancing enforcement. To establish self-reliance among local municipal bodies, the governance of Property Tax should be carried out for better monitoring and smooth governance. A financially stable local body could quickly improve residents’ quality of life and enhance the caliber of local authority that directly impacts the lives of residents.

Municipal Corporations are vital to the city’s development. Civic bodies thus bear a huge responsibility to reach out to the grassroots. Hence, municipal bodies can play a decisive role in making or marring a city. We also require the Municipal Corporation to encourage citizen participation, empowerment of women, and sustainable development, amongst other important issues resolved at the right juncture. These are the marks of an excellent Municipal Corporation that will make its city and people grow.

References:

- https://www.india.gov.in/my-government/constitution-india/amendments/constitution-india-seventy-fourth-amendment-act-1992

- https://www.indiacode.nic.in/bitstream/123456789/13729/1/the_orissa_municipal_act%2C_1950.pdf

- https://openbudgetsindia.org/budget-basics/municipal-budget.html

- https://bpac.in/bbmp-ward-committees/

- https://vidhilegalpolicy.in/wp-content/uploads/2020/07/FinancingUrbanLocalBodiesinKarnataka.pdf